However, a lot of trades are made by extremely short-term traders, some guided by algorithms. It is difficult to believe that investors changing their opinion on the fundamentals of a company or the economy would alter behavior on the basis of such a small tax.

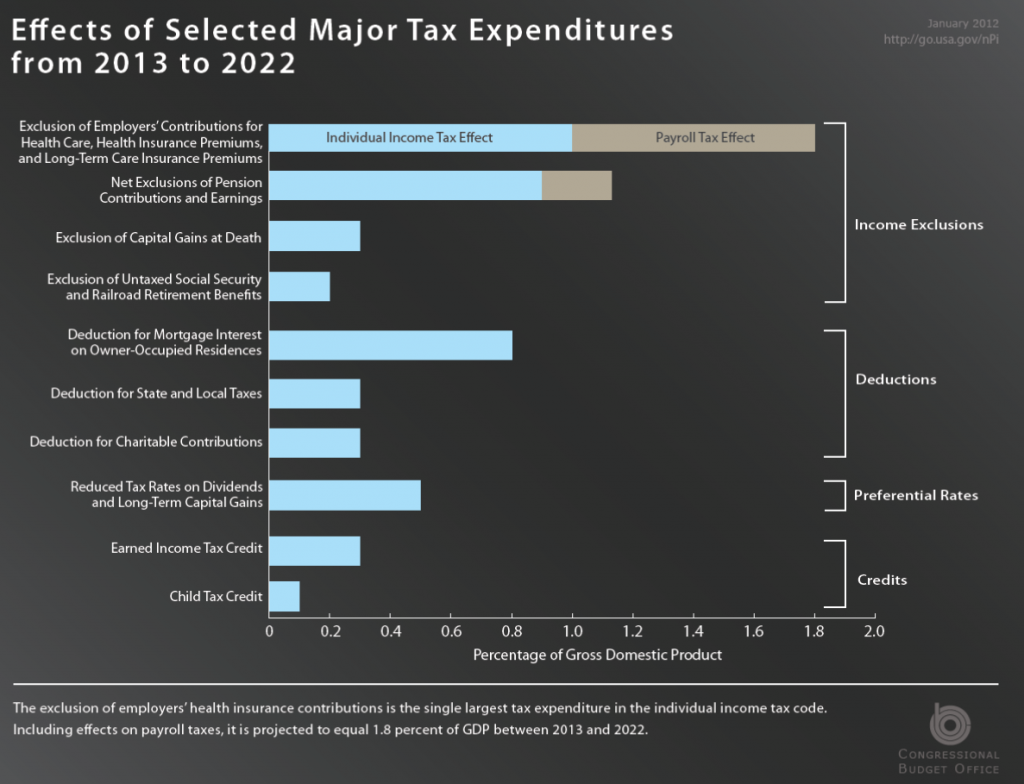

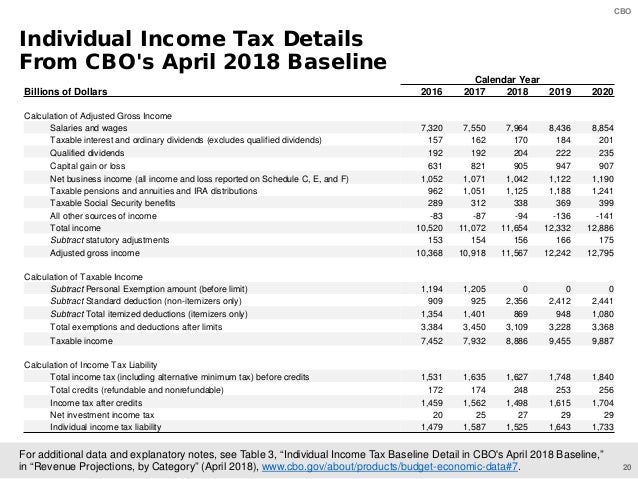

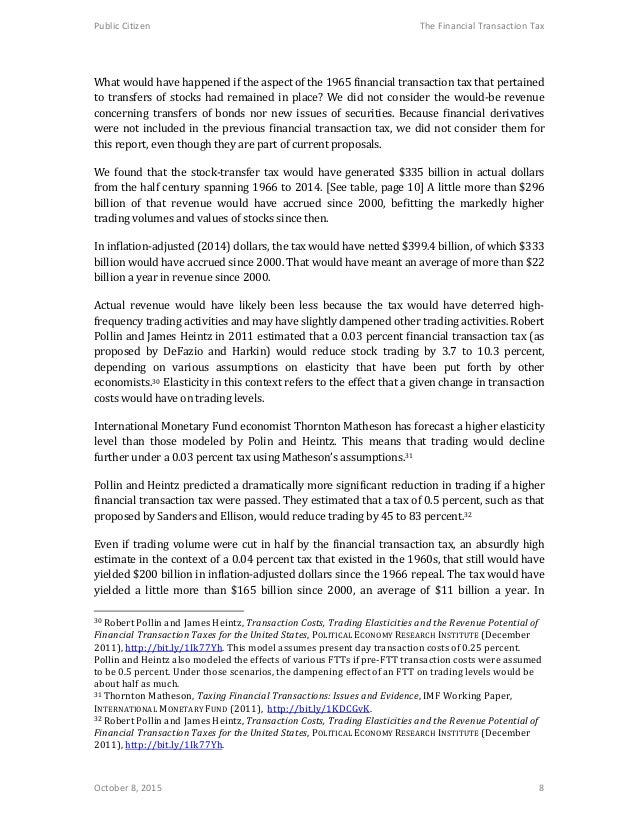

Exactly what trading would be reduced, and by how much, is critical. Critics believe that these projections are overly optimistic, and do not taking into account reductions in trading or the potential for activity to move overseas to escape the tax. That’s significant, about equal to the revenue generated by all excise taxes including gas, tobacco, and alcohol. The CBO revenue projection predicts that a 0.1% tax raises $777 billion over 10 years, accounting for 0.5% of GDP. As portfolios adjust, they pay FTTs and investors, even those who don’t own individual stock directly, would be impacted.Ī closer look How much revenue could an FTT raise?

Over half of Americans own an IRA at a median value of $60K, and just under half of those assets are in mutual funds. The bottom 60% would pay just over 11% of total revenue. The Urban-Brookings Tax Policy Center predicts that top 1% of American households would pay 40% of the total amount of the tax. This is the rate proposed by many Democratic candidates and in Congress. The Congressional Budget Office predicts a 0.1% financial transaction tax, equivalent to $1 per $1,000 traded, will generate $777 billion of new revenue over 10 years. Recent stock market volatility due to the coronavirus has roughly doubled the amount of stock trading on a daily basis. Critics argue the tax harms savers and investors, reduces economic growth, and fails to raise promised revenue by driving activities to lower taxed areas overseas. Dozens of countries impose FTTs at varying levels covering not just stocks, bonds, and derivatives, but sometimes real estate.įTT proponents highlight its progressivity (the rich pay more), its voluntary nature (don’t want to pay? don’t trade), and its ability to discourage unproductive high frequency trading. In fact, America already has an FTT, albeit extremely small: currently set at roughly 2 cents per $1,000 traded. Please refer to your advisors for specific advice.Democratic presidential candidates are proposing using a financial transaction tax (FTT), a tax on buying and selling a stock, bond, or other financial contract like options and derivatives.

Cbo financial transaction tax professional#

This material has been prepared for general informational purposes only and is not intended to be relied upon as accounting, tax, or other professional advice. For more information about our organization, please visit ey.com. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients. In so doing, we play a critical role in building a better working world for our people, for our clients and for our communities.ĮY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. We develop outstanding leaders who team to deliver on our promises to all of our stakeholders. From mitigating financial risk and addressing pension plans, to embedding your new workforce, we can help you effectively manage your people.ĮY | Assurance | Consulting | Strategy and Transactions | TaxĮY is a global leader in assurance, consulting, strategy and transactions, and tax services. The insights and quality services we deliver help build trust and confidence in the capital markets and in economies the world over. Workforce transactions and M&A: People represent the biggest cost and greatest risk in executing a transaction and ensuring business performance after the deal.Transaction law: As transactions are becoming more complex, investors need access to legal advice that helps them manage deals effectively.M&A tax planning: Our dedicated international tax professionals support you with the tax aspects and complexities of cross-border situations and transactions, including analysis, reporting and risk management.This brings the entirety of the EY tax, legal and workforce offerings to help you build trust, embrace transformation and drive growth - now, next, and beyond. Our market-leading EY team of transaction, law and workforce advisory professionals will help you drive sustainable and inclusive growth by providing end-to-end strategy, deal execution and post-deal services advice.

0 kommentar(er)

0 kommentar(er)